Your adviser delivers better insurance outcomes

It’s official.

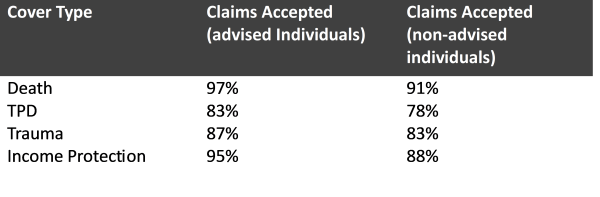

According to latest data from APRA’s Life Insurance Claims and Disputes Statistics Year Ending 31 December 2023, clients with an adviser relationship get better outcomes in the claims process than unadvised claimants.

The report shows the number of claims accepted to proceed by insurers for advised individuals were higher for all types of insurance, for the second year running.

We know this is true from experience, and so do the many clients we've assisted at some of the most difficult times in life, when the last thing they wanted to do was to deal with an insurance company.

There are plenty of insurance products out there, heavily promoted on radio, TV and online; but they simply don’t deliver when it comes to protecting you and your family at claim time.

Ultimately, our clients get better insurance outcomes because they have access to these significant advantages through their adviser relationship:

A wider range of quality products

Our advisers have access to a wide range of insurance products from quality providers. This allows us to compare different policies and find the one that best suits each client's needs and budget.

An understanding of complex policies

Insurance policies are full of complex terms, conditions and exclusions. We have the expertise to decipher these complexities and explain them to our clients in simple terms, so there are no surprises down the track.

Fully underwritten insurance that matches your needs

The Financial Services Council (FSC) estimates there are 1 million Australians who are underinsured for Death or Total Permanent Disability and 3.4 million who are underinsured for income protection. Finding out you don't have enough insurance to meet your needs at claims time is something we don't want our clients to experience.

Our close client relationships enable us to provide personalised advice on coverage amounts, policy features and duration, in line with your risk appetite and financial circumstances. We do the extra work with each client to ensure policies are fully underwritten, which means less disputes at claim time.

Ability to facilitate better policies and claim outcomes

Decades of industry experience means we have established relationships with insurance companies, so we can advocate on behalf of our clients at a time of crisis and provide via faster, more dedicated service.

Regular monitoring and review

Regularly reviewing our clients' insurance needs, and adjusting their coverage accordingly as their circumstances change, ensures they always have the right level of protection without overpaying for unnecessary coverage.

The bottom line?

Working closely with your FMD adviser will give you peace of mind that you have the right insurances in place at the best possible price to protect yourself and your loved ones.

If you have any questions about your insurance arrangements, or have family and friends who are concerned they may be underinsured, please contact your FMD adviser.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.