Why trying to time the market doesn't pay

Trying to “time the market” – the strategy of buying and selling investments based on predicting market movements – is a tempting approach for invested clients in volatile markets.

It is natural to want to avoid losses to make your money last, but it’s important to remember that retirement can be a 20-year period or more, so it’s essential to remain invested for the long-term. Timing the market is also very difficult to do and is fraught with risks that can lead to financial losses. Instead “time in the market” is the best approach for long-term investors who need consistent returns over different time horizons.

When we manage your money, we consider today – short-term cash flow needs to fund your lifestyle now; tomorrow – milestones you may be planning in the coming years, like a holiday or home renovation; and the future – investing your money for stronger returns to keep pace with inflation and fund your retirement for 10 or 15 years from now. Moving from investments to cash in volatile times may feel like a safe bet, but it runs the risk of significantly eroding that future wealth.

Let’s look more closely at why trying to time the market is such an ineffective investment strategy:

The illusion of predictability

One of the most significant dangers of market timing is the illusion of predictability. Investors often believe they can anticipate market highs and lows based on historical patterns, news events, or economic indicators. However, financial markets are influenced by a complex range of factors, including global events, investor sentiment, and geopolitical issues, making them inherently unpredictable. Even seasoned analysts frequently fail to accurately forecast market movements.

Emotional decision-making

Market timing often leads to emotional decision-making, which is detrimental to investment success. Fear or speculation are powerful emotions that can cloud judgment. During market downturns, fear can prompt investors to sell at a loss, thereby locking in their losses. Conversely, during bull markets, desire for quick, high returns can lead to buying assets at inflated prices. This buy-high, sell-low cycle is the opposite of sound investing principles.

Avoiding losses

Investors focussed on timing the market are often fuelled by fear of avoiding losses or missing out on potential gains. The interesting fact is that the most significant gains on share markets often occur during short, unpredictable periods. If an investor is on the sidelines in cash waiting for the “perfect” re-entry point, they risk missing out on these surges.

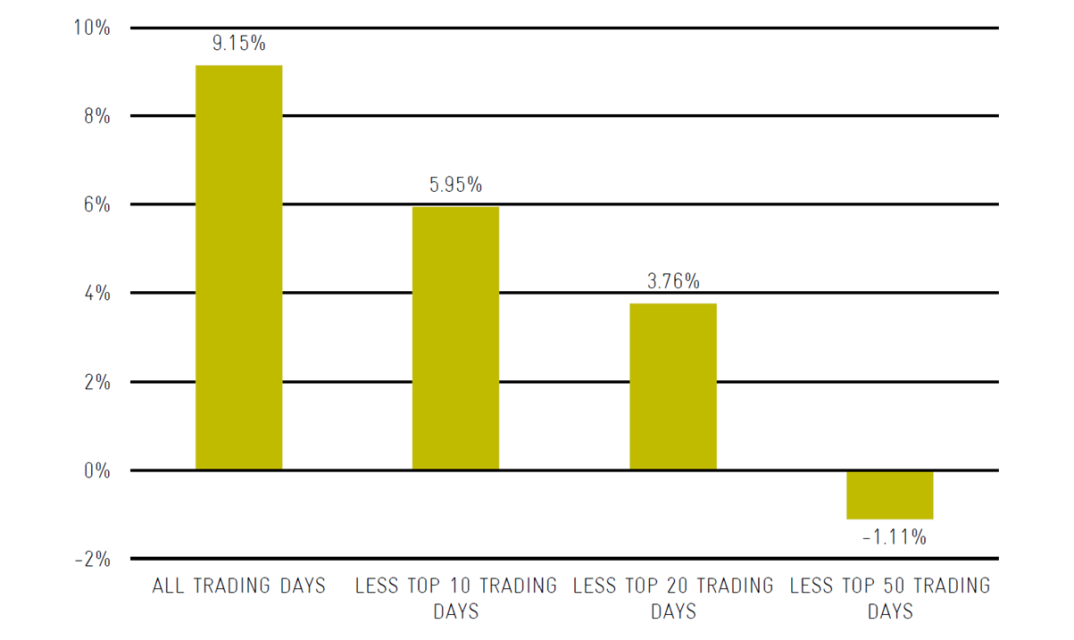

Research consistently shows that missing just a few of the market's best days can drastically reduce long-term returns. This chart from Lonsec Investment Consulting shows that if an investor misses out on the 10 best days in the market over a 20-year period, their overall returns can drop by around 35%. It's also worth remembering that despite cyclical market declines, ASX returns were positive 22 years out of the last 31, further highlighting the benefits of a long-term approach.

Being Out of the Market — Time In Versus Timing

The power of staying the course

Numerous studies have shown that most market timers underperform compared to a simple buy-and-hold strategy. According to the DALBAR Quantitative Analysis of Investor Behaviour, the average equity investor consistently underperforms the broader market, largely due to poor market timing decisions. In contrast, long-term investors with an adviser relationship and actively managed diversified portfolios, generally achieve higher returns over time, with less stress.

Time in the market and diversification deliver best results

So, we know that while the temptation to time the market is understandable, the risks far outweigh the potential rewards.

Instead, the FMD Investment Committee, with insights from our trusted research partners, regularly rebalance client portfolios to take advantage of emerging economic conditions and market trends, to keep your investment returns on track over time.

We also work with clients to look for opportunities to deploy funds towards diversified investments on a regular basis, to ensure you benefit from dollar-cost averaging – effectively buying into shares at different times in the market cycle. This approach has delivered consistently for our clients during times of market volatility and growth over decades.

So, next time you’re tempted to try and time the market, remember that time in the market is always better for long term investors. If you have any questions about our investment philosophy or your financial plan or investment portfolio performance, please speak with your FMD adviser.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.