Federal Budget 2025 – What it means for you

Treasurer Jim Chalmers handed down the 2025 Federal Budget with a clear eye on the upcoming election, aiming to walk a careful line: easing household pressure without adding to inflation and hoping for further interest rate cuts. The forecast is a return to a modest deficit after two years of surpluses.

For most of our clients the cost-of-living announcements will be beneficial, while for the retirees receiving Centrelink pensions, the unfreezing of deeming rates is something to monitor. For high-net-worth individuals, the 30% tax on Super over $3 Million remains of concern, although most measures still need to be legislated.

Superannuation

30% Tax on Super Balances Over $3 Million (Division 296)

Despite widespread pushback, particularly over concerns about taxing unrealised capital gains, the government has confirmed it will proceed with the 30% tax on earnings from super balances above $3 million, effective 1 July 2025. Importantly the measure has not yet passed the Senate and will lapse if not legislated before the election.

Should this become law, we will work with clients near or above this threshold to minimise the impact of this change, as for example couples can hold $6m before this tax would apply.

Super Guarantee to Rise to 12%

The legislated increase from 11.5% to 12% takes effect on 1 July 2025. This will benefit employees and business owners paying themselves SG.

Payday Super

From 1 July 2026, super must be paid at the same time as wages. This change is not yet legislated, but bipartisan support makes it likely to proceed. Business owners should review payroll systems in advance.

No Simplification Measures

There were no changes to contribution caps, thresholds, or the transfer balance cap. Super is structurally unchanged for now.

Personal Income Tax

Proposed Additional Tax Cuts

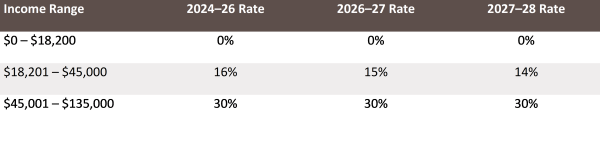

Following the already legislated Stage 3 tax cuts (from 1 July 2024), the government proposes to further reduce tax for low-to-middle income earners:

These cuts would deliver savings of up to $268 in 2026–27 and up to $536 from 2027–28. For retirees drawing income from trusts or investments, there may be modest benefits depending on their taxable income.

If implemented, the marginal income tax rate for those on lower incomes may fall below the 15% concessional super tax rate. This could reduce the tax effectiveness of voluntary concessional contributions for some clients and should be reviewed.

Cost-of-Living Support

Energy Bill Credit

The Government will extend energy bill relief measures originally announced in the 2024–25 Budget providing eligible Australian households and small businesses and additional $75 over the final two quarters of 2025. Clients with multiple residences, such as holiday homes, may receive the credit more than once depending on billing arrangements.

PBS Medicine Costs

From 1 January 2026, the general PBS co-payment will fall from $31.60 to $25. The concessional co-payment of $7.70 will be frozen until 2030. Clients managing chronic health conditions should see meaningful annual savings.

Student Loan Relief

From 1 June 2025, Higher Education Loan Program (HELP) and student loan balances will be reduced by 20%. From 1 July 2025, the repayment threshold will rise from $54,435 to $67,000. This may benefit younger family members or adult children with student debt.

Help to Buy Expansion

The property price and income caps under the Help to Buy scheme will be increased, improving access for eligible first homebuyers.

Social Security

Medicare

Levy Thresholds Increased (Retrospective to 1 July 2024)

Thresholds for dependents also increased. Some low-income retirees may now pay less or no Medicare levy as a result.

Deeming Rates

Despite speculation, no extension to the deeming rate freeze was announced. Rates remain frozen until 30 June 2025. If they rise thereafter, some clients could face significant Age Pension reductions. For example, a single homeowner with $310,000 in financial investments could see their annual pension fall by over $5,800.

Aged Care and Healthcare

Support at Home Program

The government reaffirmed funding for the Support at Home program, which will begin in July 2025. While previously announced, it reflects ongoing efforts to expand access to flexible in-home aged care.

Bulk Billing and Urgent Care Clinics

An additional 50 Medicare Urgent Care Clinics will be opened, and incentives to bulk bill will be increased. The government has a target for 90% of GP visits to be bulk billed by 2030.

In Summary

This Budget is more evolutionary than reformist. It reflects pre-election positioning and aims to ease cost-of-living pressure without destabilising economic settings. For FMD clients, key considerations include:

• The 30% tax on large super balances is progressing but not yet law

• Additional tax cuts are proposed from 2026 and 2027, subject to legislation

• Energy, PBS and Medicare relief continue

• No extension to the deeming rate freeze: pension planning may be needed

• Aged care reforms remain on track, but unchanged

We will continue to monitor these announcements, but please contact your FMD adviser if you have any immediate questions.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.