Becoming a Super hero - everything you need to know about superannuation to live the dream

Super regulations are always changing - there have been 43 legislative and regulatory changes in Self-Managed Super alone in the last five years! (1)

While super may still be the most tax-effective way to build and maximise wealth, its complexity is frustrating for busy professionals. Who has the time to keep up with it all, let alone make sure you're making the most of every change to grow your super balance to live the lifestyle you want in the future?

The good news is that you don't have to because we can do it for you. Our clients benefit from our ongoing stewardship of their super, constantly optimising their mix of investments through our Active Management System so they can live the dream. You can read their stories here.

Significant superannuation changes over the last five years

- 1 July 2014: The Superannuation Guarantee (SG) increased from 9.25% to 9.5%, the first step in what was to be a progressive increase to 12% by 2019. (The start of this planned increase has since been deferred to 1 July 2021) Meanwhile, high income earners needed to beware of going over the $35,000 contributions cap.

- 1 July 2015: The preservation age, i.e. the minimum age a person must reach before being able to access their super benefits, was increased from 55 to 56 for those born on and after 1 July 1960. The preservation age will gradually increase to 60 in the coming years.

- 1 July 2016: The Government kept their promise of not making any significant changes to super - the calm before the super storm of 2017.

- 1 July 2017: This was one of the biggest shake-ups the superannuation industry had ever seen. The introduction of a $1.6 million cap on the amount of capital that can be transferred to, or retained in the tax-free earnings retirement phase of superannuation, and reducing the annual concession (before tax) contributions limit to $25,000 for everyone, were just two of the many significant changes we saw. July 2017 made it more important than ever to have a proactive investment strategy for your super and start planning earlier in your career.

- 1 July 2018: Those aged 66 and over were now able to make an additional super contribution of up to $300,000 each ($600,000 combined) from the sale of their family home. This created a huge opportunity for downsizers to boost their superannuation.

- The 2019 financial year will see more changes, most notably the Protecting Your Super reform package legislated to protect Australians' super accounts from being eroded by insurance policy fees and premiums.

The bottom line: If you're not getting strategic advice about your super investments, you could miss out on hundreds of thousands of dollars by the end of your peak earning years

Previously, high income earners could play catch-up with their super contributions later in life when mortgages were paid off. After the contribution cap changes introduced in 2017, it has become crucial to boost super as much as possible during your peak earning years. If you're 10-20 years away from retirement it’s time to ask yourself, ‘How much could my super grow if I made an active choice about my investment strategy now?’

Take a look at the below numbers. They show you how you could have an extra $300,000 in super by making a single decision: moving from a Balanced Fund to a High Growth Fund.

Is this the right solution for you? It depends on your personal circumstances and risk appetite. But should you take the time to figure out if it is? Absolutely.

Most people just sign up to their employer's default fund. This hands-off approach is akin to leaving hundreds of thousands of your hard-earned dollars on the table. Speaking of which, most people don't make personal contributions either. According to ASFA statistics, personal contributions in the March quarter 2019 were $3,976 million, down from $5,305 million the same quarter in 2017.

The upshot? The lifestyle you’ll enjoy later comes down to the action you take now. Not in five years or ten years, but right now while you still have time to benefit from market cycles and the power of compound interest.

Is a self-managed super fund (SMSF) the way to go?

If you want complete control over your investments, or you enjoy the challenge of the complexities involved in managing your own long-term financial strategies, an SMSF might be a good option for you. In this article, FMD Director and Financial Adviser, Mike Reynolds, breaks down the reasons an SMSF may be right for you.

Ultimately, an SMSF is just a vehicle by which you can hold an asset, this can be done inside or outside of super, it’s just a matter of working through the advantages and disadvantages of each strategy, to identify what will work for your personal circumstance.

It’s an unfortunate reality that the very things investors find so appealing about having an SMSF – control over their investments and the flexibility to concentrate on investment strategies where they’ve had previous experience or success, such as property or direct shares – can serve to limit long-term investment returns through a lack of diversification, in turn putting their retirement savings and future lifestyle at risk.

As with all investment strategies, if you simply don't have the time or expertise to closely manage and adapt the investment strategy within your SMSF, seek advice from a qualified adviser. This way, you can have the control and autonomy you want, with the support of a proven investment committee behind you. You can still call the shots without going it alone.

DIY or talk to a qualified financial adviser?

While it’s essential to play an active role in your finances, it’s just as important to play to your strengths. If you have the time and investment knowledge to analyse market data and manage your super investment portfolio on a monthly basis, this could be the right approach for you.

However, most successful professionals or business owners simply don't have the time or expertise to do this well, so instead their super languishes in a default fund growing at a much slower rate than it potentially could.

That's why so many clients have benefited from meeting with an FMD adviser to model the potential impact of different investment strategies on your long-term super balance. It could be one of the most profitable hours you ever spend if it results in a much bigger super balance at the end of your working life. It could be the difference between a cabin in Rosebud or a villa in Rome!

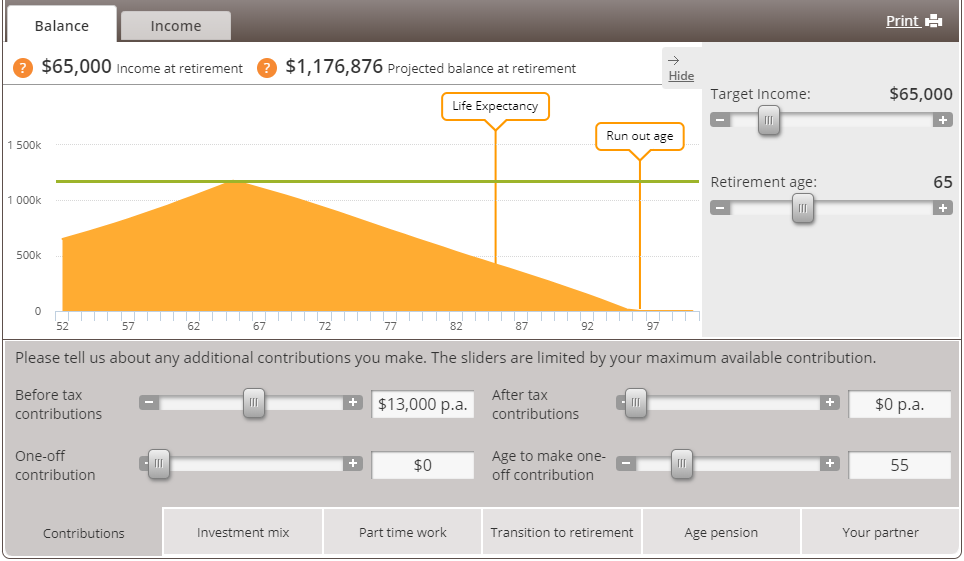

We can model a range of superannuation scenarios for you so instead of wondering if your super is on track, you'll know

If you book a meeting with one of our advisers, we’ll sit down with you and talk about your financial situation and goals for the future. Then we’ll use our super modeller to shed light on your situation and discuss strategies for achieving your goals. There is no charge for the initial meeting and no obligation to seek ongoing advice, but you’ll leave with many of your questions answered.

If you’ve been meaning to do something about funding your retirement goals but find yourself putting it off for years, make this the year you commit to making the most of your money by seeking professional financial and investment advice. If you decide to do this, you will likely have two important questions:

- How to find an adviser you can trust? For starters, avoid the big banks and look for a qualified adviser (CFP®) with strong client endorsement.

- How much will it cost? We're upfront about our approach and fees because we have over 15 years of proven results and happy clients to back them.

The benefits of professional financial advice

When you work with our qualified, experienced advisers, you can be sure that:

- The personal financial plan we develop for you will save you time, energy, worry and paperwork

- The financial mistakes we will help you avoid will save you thousands of dollars per year

- You’ll know first-hand the peace of mind that comes with having a plan to secure your financial future

- The long-term investment returns we’ll achieve for you will out-perform the portfolio mix you may choose yourself

You work hard for your money. Now let your money work smart for you.

Create the retirement lifestyle of your dreams

(1) Source: https://www.superguardian.com.au/pdfs/Super-changes-timeline.pdf

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.