Economic Snapshot: Strong returns on equity markets

Against a backdrop of disinflation, evidence of a “soft-landing” and the beginning of a global interest rate easing cycle, 2024 proved to be another strong year for equity markets. Notwithstanding a modest sell-off in December and a flat quarter, global equities returned 31% in AUD terms.

The Australian equity market finished the year on a weak note but still managed to produce an 11.4 % return for the year. The banking , insurance, retailers, diversified financials, REITs, utilities, and industrials sectors all managed strong returns for the year.

Global bonds declined 1.2% in the December quarter, cutting the 2024 return to just 2.2%. Australian bond yields ended the year at 4.4%, below those of the US, after rising as high as 4.71% in November.

In January a better-than-expected inflation result had markets clamouring for a rate cut, which was duly delivered at 0.25bps at the February 2025 meeting of the Reserve Bank of Australia.

Since the beginning of the new year, global equities began on a strong footing, with European stocks outperforming the US by the largest margin since late 2022, as Chinese start-up DeepSeek challenged US leadership in artificial intelligence. Global equities rose 2.7% in January and for the 12 months, the global index is up 28.9% in AUD terms.

The Australian equity market also outperformed US stocks, helped by a low weighting to AI-related stocks and a heavy weighting to financials. The Australian market rallied 4.6% to take the rolling 12-month gain to 15.2%, still lagging global markets. From a sector perspective, the financials sector was up more than 6%, consumer discretionary stocks rose 6.8% while the materials sector managed to gain almost 4%.

Global Bonds returned 0.4% in January, taking the 12-month gain to 3%. Australian bond yields were remarkably steady in January, ending the month at 4.46%.

Asset Class Returns - Full Year to December 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 130, December 2024

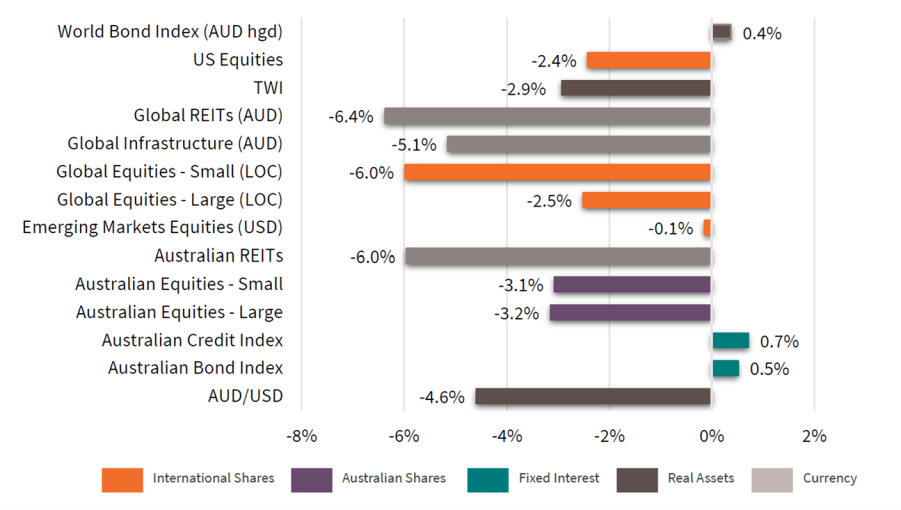

Asset Class Returns - December 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 130, December 2024

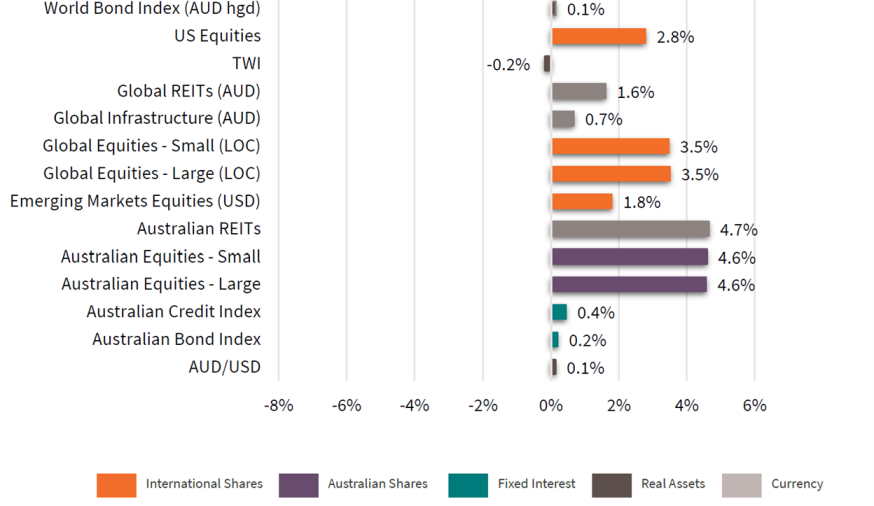

Asset Class Returns - January 2025

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 131, January 2025

Global Developed Equities

Despite economic uncertainties, 2024 proved to be another strong year for global equity markets. US stocks, particularly AI-driven “Magnificent 7” companies, led the way, benefiting from high profit margins and robust earnings growth. The MSCI World ex Australia index returned 19% in USD terms (31.2% unhedged), boosted by a weaker Australian dollar, which fell from 69 to 62 US cents.

The US economy defied expectations:

• Economic growth over 2.5% despite past interest rate hikes;

• The S&P 500 hit 57 record highs, rising 25%;

• Earnings grew 9% overall, but tech-heavy sectors surged 20-30%;

• The Federal Reserve cut interest rates three times, ending the year at 4.5%, though future cuts may be limited , and;

• Bond yields climbed, yet equity markets remained resilient, buoyed by strong earnings and expectations of pro-business policies under President-elect Trump.

Elsewhere, Europe struggled with weak growth and political instability, particularly in Germany and France. Japan performed well, supported by corporate reforms and steady

earnings. In sector trends, pro-cyclical stocks thrived, while defensive sectors like healthcare and consumer staples underperformed. Growth stocks led the market, returning nearly 26% for the year.

Global equities started 2025 strong, with European stocks outperforming the US as Chinese AI firm DeepSeek challenged US dominance. The MSCI World ex Australia index rose 3.5% in January, with Europe ex-UK up 7.4% and the US up 3%.

Tech stocks struggled, with NVIDIA falling 20% after DeepSeek’s AI breakthrough. Despite volatility, US earnings grew 13.2% year-over-year, led by financials and consumer sectors.

The Fed held rates, while bond yields hit 4.8% before easing on lower inflation. President Trump’s tariffs on Canada and Mexico created market swings, while Europe saw economic improvement and a rate cut. Japan underperformed as its central bank raised rates.

Australian Equities

The Australian share market ended 2024 on a weaker note but still delivered an 11.4% return. Unlike the US, earnings growth was scarce, with returns driven by rising valuations despite the Reserve Bank of Australia (RBA) holding rates steady at 4.35% due to persistent inflation.

Banks gained 35.6% for the year, despite little earnings growth. Insurance, retailers, REITs, and utilities also performed well, while the materials sector struggled, losing 13.7%. Headline inflation dropped to 2.3%, helped by falling electricity prices, but core inflation remained high at 3.5%, limiting rate cuts in the calendar year.

By the end of the year, the RBA was hinting at growing confidence in inflation trends, raising market expectations for a rate cut in early 2025, which was duly delivered at 0.25 bps at the February meeting.

With stabilising inflation, a possible easing cycle, and election-driven fiscal stimulus on the horizon, the market outlook remains cautiously optimistic despite valuation challenges. However, the RBA governor Michelle Bullock was cautious on further rate cuts in the near future.

In January, although still lagging global markets, the Australian equity market outperformed the US, rising 4.6%. Financials rose 6%, consumer discretionary 6.8%, and materials nearly 4%.

While largely unaffected by Trump’s tariffs, Australia remains sensitive to China’s economic outlook, with a worsening US-China trade war posing potential risks.

Emerging Markets

Emerging markets (EM) struggled late in 2024, with the MSCI EM index dropping 8% in the final quarter but still posting a 7.5% annual gain (18.5% in AUD terms). Concerns over tariffs, a potential trade war, and a stronger USD weighed on sentiment.

China’s market rose 19.4%, supported by stimulus measures, although investors wanted more direct fiscal support. Economic challenges persist, with weak retail spending and a struggling real estate sector.

Asia’s EM markets had mixed results across 2024. Taiwan surged 34%, while Korea and India saw late-year declines. Latin America underperformed, losing 26% for the year. In 2025, tariffs and USD strength will be key risks.

As 2025 commenced, emerging markets faced pressure from trade tensions, tariffs, and a stronger USD. Despite this, the MSCI Emerging Markets Index rose 1.8% in January, bringing its rolling annual return to 14.8%.

China’s market gained 0.9%, supported by improving economic data and softer-than-expected US tariff proposals. China’s economy grew 5.4% in Q4, helped by stronger exports and credit growth. In 2025, tariffs and USD movements will be key, with interest rates shaping the USD’s impact on global markets.

Property and Infrastructure

After a strong November, global REITs and infrastructure sectors declined in December as rising US bond yields, driven by strong growth and Trump’s pro-growth policies, pressured valuations. GREITs fell 7.5% in Q4, limiting annual gains to 2.8%. Global infrastructure lost 3.4% in the quarter but delivered a solid 12.1% return for the year.

Despite this decline in December on the back of higher bond yields, REITs managed to edge higher in January. AREITs returned 4.7% to lift the annual return to 22.4% while GREITs rose 1.6% for a more subdued 8.1% gain over the year. Global Infrastructure gained 0.7% in January, taking the annual advance to 14.9%.

Fixed Interest – Global

Bond markets experienced sharp swings in 2024, shifting from expectations of multiple Fed rate cuts to a “higher for longer” stance, before settling on a soft-landing outlook.

The Fed cut rates by 50 basis points (0.5%) in September, briefly pushing US bond yields to 3.63%. However, strong economic growth, persistent inflation, and Trump’s election victory and anticipated pro-growth agenda drove yields up to 4.57% by year-end.

Most of this increase was due to rising real yields, as inflation expectations remained stable. European bond yields rose more modestly, with the ECB expected to ease rates four times in 2025. Japan, meeting its inflation target, may tighten policy up to three times.

Despite cooling job growth, the US economy expanded 2.8%, keeping further Fed cuts uncertain. Global bonds struggled, with the Barclays Global Aggregate index returning just 2.2%, while high-yield bonds outperformed, gaining 9.6% amid narrowing credit spreads.

However, by mid-January, US bond yields spiked to 4.79%, driven by strong job growth and a pro-tariff policy stance. Concerns over the US deficit and inflation pushed the 10-year Treasury term premium higher.

However, yields eased to 4.58% by month-end as inflation data came in softer than expected. The Fed remains cautious, with no urgency to cut rates. In Europe, bond yields rose on fiscal concerns, with UK yields briefly exceeding 5%. Global bonds posted modest gains, with investment-grade credit up 0.6% for the month and high-yield bonds gaining 1.3%.

Fixed Interest – Australia

Australian bond yields ended 2024 at 4.4%, down from a November peak of 4.71%. The RBA kept the cash rate at 4.35%, but a shift in its tone led markets to price in a possible rate cut as early as February, with expectations of 3.6% by year-end.

Wages growth eased to 3.5%, and headline inflation fell to 2.3%, though core inflation remained high. Business confidence improved, consumer sentiment strengthened, and unemployment dipped below 4%. The Bloomberg Composite index gained 2.9% for the year.

Australian bond yields remained stable in January, ending at 4.46%, as the RBA kept the cash rate at 4.35%. Softer-than-expected inflation data had markets anticipating a February rate cut, with markets expecting up to four cuts this year.

Core inflation eased to 3.2% annually, with the lowest quarterly rise since mid-2021. Business confidence and consumer sentiment improved, while unemployment remained below 4%. With signs of economic stability, the RBA is likely to cut rates gradually. The Bloomberg Composite Index gained 0.2% in January, bringing its annual return to 2.9%.

Commodities

Oil prices fell in 2024, with Brent crude ending at $74.80 per barrel, down 2.9%, as weak demand, OPEC’s uneven production cuts, and expectations of higher US output kept prices in check.

Copper dropped 10.9% in Q4 but posted a slight annual gain, while iron ore rebounded above $103 per tonne despite losing over 25% for the year due to China’s slowdown. Gold, however, surged 27%, closing at $2,624 an ounce.

In January, commodity markets were mixed. Gold rose a further 6.8% to US$2,798 an ounce, up 37.3% for the rolling 12-month period, driven by geopolitical risks, inflation, and central bank demand. Brent crude rose 2.6% to US$76.77 but stayed within its trading range.

Copper gained, while iron ore remained above US$100 a tonne despite losing over 25% in 2024 due to China’s economic slowdown.

Currencies

The USD ended 2024 strong, driven by robust US growth, higher interest rate expectations, and Trump’s pro-growth policies. The euro fell 7% to 1.035, while the pound dropped over 6%. The yen weakened to 157 per USD, reversing post-rate hike gains.

The AUD declined over 10% in Q4 to 62 cents, impacted by widening interest rate differentials and weaker commodities. Meanwhile, the Chinese yuan neared record lows at 7.37 per USD.

After a volatile end to 2024, currency markets stabilised in January. The USD gained 5% over the year, with the euro at 1.025, the yen at 154.8, and the AUD near its lowest at 61.6 cents. The BOJ’s rate hike briefly supported the yen, but US rates remain higher.

Looking for personal financial advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.