Economic Snapshot: Interest rate outlook impacts markets

Recent market trends have been marked by significant shifts in expectations regarding central bank policies and inflation. Starting the year off, there was anticipation of possible interest rate cuts by the Reserve Bank of Australia (RBA).

However, this outlook has changed, with markets now pricing in the prospect of a rate hike instead. This change in expectations has been influenced by several factors, including higher-than-expected inflation rates for the third consecutive month.

This unexpected inflation, along with a re-evaluation of Federal Reserve policies and an increase in bond yields, led to a notable decline in equity markets. In fact, global equities experienced a 3.3% decrease in April, following a robust 14.1% increase for the first quarter of the calendar year.

Australian equities also pulled back, declining 2.9% in April after a 5.3% gain in the March quarter.

Real estate investment trusts (REITs), which generated a strong 16.8% increase in the first quarter, were particularly affected by higher bond yields in the month, experiencing a 7.6% decrease. Additionally, sectors such as consumer discretionary, banks, and energy all saw declines of 3.5% or more.

The upward trend in global bond yields continued throughout the month, driven by another round of higher-than-expected inflation data and positive economic indicators.

Australian 10-year bond yields, for instance, rose to 4.54% before settling at 4.44% by the end of the month – compared to around 4% at the beginning of the month.

These shifts indicate a broader reassessment of economic conditions and monetary policies, highlighting the challenges and uncertainties facing financial markets in the current environment, as economies perform better than expected and inflation remains uncomfortably high.

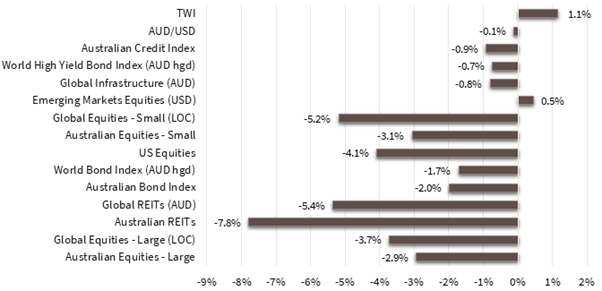

Asset Class Returns - April 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 122, April 2024

Global Developed Equities

In April, global markets faced challenges due to higher inflation, leading to the largest equity market decline since October 2023.

The MSCI World ex-Australia index pulled back 3.7%, following a strong 9.1% gain in the previous quarter.

US core inflation remained high at 3.8%, affecting market expectations for Federal Reserve interest rate policy. As a result, the US 10-year yields rose to around 4.7%, impacting equity and bond valuations alike.

The US market was down by 4.2% due to declines in large tech companies. However, the UK market rose by 1.9%, while other markets, like Europe ex-UK and Japan generally declined.

Company earnings, a sign of corporate health, have remained strong with 77% of companies in the S&P 500 index reporting positive EPS (earnings per share or profits) surprises and a 5.0% earnings growth rate, the highest since February 2022.

Economic data was mixed, with US ISM (Institute of Supply Management) indices easing back in April and some softening in labour market indicators and consumer confidence.

Some commentators have mentioned the possibility of “stagflation”, but Fed chair Jay Powell was quick to rule this out, stating at the press conference following the recent Federal Open Market Committee meeting “I don’t see the stag, or the ‘flation”.

In terms of market sectors, utilities and energy were the only ones to post positive returns, while IT, REITs (real estate investment trusts), construction materials, and retailers were the biggest losers. Defensive stocks outperformed, while Growth and Quality stocks underperformed Value stocks.

Australian Equities

Australian equities declined by 2.9% in April after a 5.3% gain in the previous quarter, with only the materials sector making a positive contribution.

REITs fell by 7.6% due to rising bond yields, while consumer discretionary, banks, and energy were each down over 3.5%.

The weaker performance in the month was due to higher-than-expected inflation data in Australia and the US, leading to a less supportive interest rate outlook – expectations of central banks’ interest rate policies; prior to April, cuts were expected by mid-to late-2024, these cuts are now not expected until later in 2024 or into 2025.

Australia's inflation rose 1% in the March quarter, leaving the annual rate at 4%. Markets started pricing in the possibility of an RBA rate hike, contrary to earlier expectations of rate cuts.

Consumer sentiment has been impacted by concerns over rates and financial conditions, with retail spending falling 0.6% in March.

However, miners saw a recovery due to rising iron ore and copper prices, along with expectations of further growth improvements in the abnormally sluggish Chinese economy.

Emerging Markets

Emerging markets, particularly Chinese equities, outperformed global developed markets.

The MSCI Emerging Markets (EM) index rose by 0.9% in AUD terms, with EM Asia up by 0.9%, China by 6.6%, and India by 2.3%. However, Korea, Taiwan, and Latin American stocks were lower due to Brazil's sell-off.

Chinese equities have rebounded by 16.6% in the past 3 months, showing signs of economic stabilisation with the Purchasing Managers’ Index (PMI) readings above 50 (indicating an expansion when compared with the previous month) and moderate retail spending.

Yet, consumer confidence remains low, and the lack of significant government support for the property sector is a concern.

The US's higher interest rate scenario is challenging for emerging markets, leading to unexpected rate hikes in countries like Indonesia, and interventions in Japan, Vietnam, Malaysia, and South Korea to support their currencies.

Property and Infrastructure

REITs declined sharply after a strong start to the year, with the (Australian) AREITs index dropping 7.6% in April, erasing almost half of the previous three months' gain. This was due to the ongoing rise in bond yields in the period.

Global REITs (GREITs) also performed poorly, falling 5.4% in April and lagging behind AREITs by nearly 20% over the year. The FTSE Global Infrastructure index fell by 0.8% in April due to higher real bond yields impacting the sector.

Fixed Interest – Global

Bond yields rose due to higher-than-expected inflation and positive economic data, reducing expectations of central bank easing in the near term.

US core inflation reached 3.8%, leading to market adjustments and a rise in US 10-year yields to 4.7%.

Economic indicators like the ISM indices and payrolls data softened, prompting stagflation concerns, although Fed Chairman Powell ruled out this possibility. Japanese bond yields rose, and the yen weakened significantly.

In Europe, bond yields increased modestly due to slower growth and inflation progress. The Barclays Global Aggregate index fell by 1.7% in April, and corporate credit spreads indicate ongoing economic expansion.

Global high yield credit returned -0.7% for the month and 10.4% for the year.

Fixed Interest – Australia

Australian bond yields rose to 4.44% amid a sell-off, driven by higher-than-expected inflation data.

Australia's inflation rose by 1% in the March quarter, leaving the annual rate at 4%, leading markets to anticipate a potential rate hike by the RBA, contrary to earlier expectations of rate cuts.

Despite a small loss in jobs and a slight increase in the unemployment rate, the economy remains stable, with business conditions not as pessimistic as expected.

Looking for personal financial advice?

This investment update is a general overview of market movements in March 2024. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.