Economic Snapshot: Inflation heading in the right direction

Inflation, though still higher than desired, is finally moving in the right direction.

With economic growth slowing down, the Reserve Bank of Australia (RBA) might have room to ease policy before the year is out. In fact, markets were expecting that the cash rate at the end of the year would be 4.5% but this has been adjusted downward to 4.15%, contributing to a decline in bond yields.

In July, global equity markets saw a 2.7% rise, bringing the year-to-date return to 17.4% in Australian dollar terms. The Australian equity market performed even better, outpacing global equities with a 4.2% gain for the month. This pushed the year-to-date gain to 8.6%. The banking sector was the standout performer, with bank stocks surging 7.1% after a strong 5% rally in June.

Meanwhile, the US 10-year bond yield fell from 4.44% to 4.09% in July, and weaker payroll data in early August pushed yields further down to around 3.8%. In Australia, bond yields also declined, dropping from 4.37% to 4.12%, which helped the Bloomberg Composite bond index post a 0.6% return for the month.

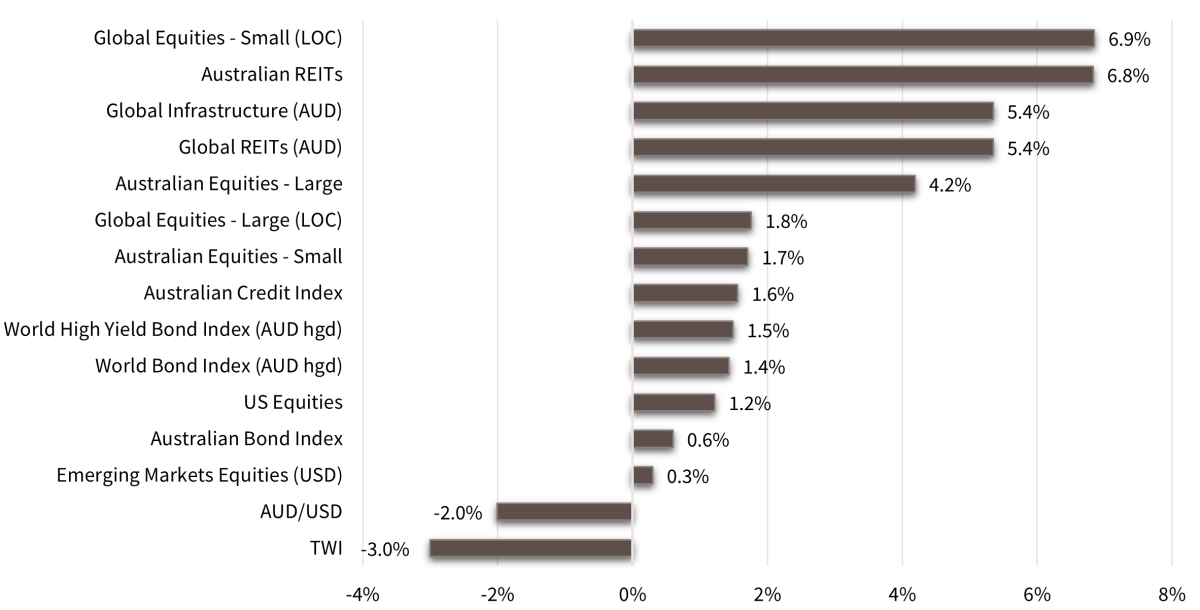

Asset Class Returns - July 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 125, July 2024

Global Developed Equities

Global equity markets rose by 1.8% in July, bringing the year-to-date return to 13.9% in USD terms and 17.4% in AUD terms for the MSCI World ex-Australia index.

The S&P 500 hit a record high on July 10 but ended the month slightly lower. The Federal Reserve’s more optimistic view on inflation led to expectations of a rate cut in September, though market volatility increased due to several events, including political developments in the US and Europe.

Despite a challenging month for large tech stocks, small-cap stocks in the US saw a strong rally, with the Russell 2000 index gaining 10.1%. Sector performance varied, with defensive sectors like REITs and Healthcare doing well, while Communications and IT sectors declined.

A key development (after the end of the month) was the Bank of Japan’s unexpected rate hike, which strengthened the yen and caused a significant impact on Japanese equities and global markets. Overall, while growth-oriented investments faced headwinds, value stocks and certain international markets outperformed.

Australian Equities

The Australian equity market outperformed global equities in July, rising 4.2% and bringing the year-to-date gain to 8.6%. Banks led this growth, with a 7.1% increase following a 5% rise in June, pushing bank valuations to near-record levels.

The market was buoyed by better-than-expected inflation data for the June quarter, which showed a 1% rise in headline inflation and a 0.8% increase in core inflation, bringing the annual rate down to 3.9%.

Although inflation remains above target, it is moving in the right direction. This has led to speculation that the Reserve Bank of Australia (RBA) may ease policy settings before year-end, with market projections for the cash rate falling from 4.5% to 4.15%, which also helped lower bond yields.

However, concerns persist due to policy tightening in Japan, a stronger yen, and ongoing economic weakness in China, which are creating uncertainty in the global growth outlook.

Earnings growth expectations for the Australian market remain subdued at less than 5%, and dividends are below 4%, presenting challenges for the market.

Emerging Markets

Emerging markets rose 1.8% in AUD terms, bringing the year-to-date return to 7.8%, still underperforming compared to global and domestic equities.

Latin America gained 1%, while EM Asia dipped slightly. India was a standout, rising 4% in July and 21.5% year-to-date. In contrast, Taiwan fell 4.3%, reducing its year-to-date gain to 23.9%.

Chinese stocks continued to struggle, with disappointing manufacturing, retail data, and ongoing property sector weakness. A small rate cut and the Third Plenary Session of the CCP failed to boost confidence due to a lack of immediate economic reforms.

Emerging markets remain relatively cheap compared to developed markets, and the USD has lost upward momentum, which could support this asset class. However, without stabilisation in the Chinese economy and a rebound in global trade, emerging market equity performance may remain limited.

Property and Infrastructure

With the US labour market softening and inflation lower than expected, markets are anticipating at least two rate cuts in 2024. This led to a decline in bond yields, benefiting interest rate-sensitive sectors.

The Australian Real Estate Investment Trusts (AREITs) index gained 6.8% in July, more than reversing the previous month's loss, and is up 17.7% year-to-date.

Global REITs also rose 5.4% in July, though they have only gained 3.1% year-to-date, partly due to challenges in the office sector. The FTSE Global Infrastructure index increased by 5.4% in July but has lagged broader markets this year.

Fixed Interest – Global

In June, US inflation was lower than expected, strengthening the case for a potential rate cut by the Federal Reserve in September. Although inflation won’t quickly return to the Fed’s 2% target, recent data shows clear disinflation.

The weaker July payroll data shifted concerns from inflation to recession, leading to a further drop in bond yields, with the US 10-year bond yield falling from 4.44% to around 3.8% in early August.

Market expectations for Fed rate cuts in 2024 increased, reflecting better inflation data but weaker economic indicators. Japan’s surprise 15 basis point rate hike and reduced bond purchases strengthened the yen and impacted global markets, causing a dip in equities and credit spreads. The Bank of England cut its rate by 25 basis points, marking the start of an easing cycle, despite ongoing inflation risks.

The Barclays Global Aggregate index rose 1.4% in July, bringing its year-to-date return to 1%. Corporate credit spreads remain stable, indicating continued economic expansion.

Fixed Interest – Australia

Australian bond yields fell to 4.12% from 4.37%, leading to a 0.6% return in the Bloomberg Composite bond index. June quarter inflation was lower than expected at 0.8% for the core measure, bringing the annual rate to 3.9%.

While inflation remains above target, it's moving in the right direction, and with subdued economic growth, the Reserve Bank of Australia (RBA) may ease policy before year-end. Market expectations for the year-end cash rate have dropped from 4.5% to 4.15%, contributing to the decline in bond yields.

Economic activity remains subdued, with weak consumer spending reflected in the seventh contraction in retail trade volumes over the past eight quarters. Business forward orders are also declining. However, government spending, tax cuts, and energy bill support are helping to keep the overall economy growing.

Commodities

Commodity markets weakened in July due to signs of slower global growth and limited policy action from China. Brent crude oil dropped 6.4% to $80.84 per barrel, despite a late rebound from Middle East tensions.

Copper, a global growth indicator, fell 4.3%, and iron ore was down slightly, with a 25% decline year-to-date. Gold was one of the few commodities to rise, gaining 5.2% to $2,447.45, driven by lower real yields, expectations of US rate cuts, and increased geopolitical risks, resulting in an 18.6% increase for the year.

Currencies

The yen surged 7% after Japan's surprise 15 basis point rate hike to 0.25%, viewed as a "hawkish" move.

The Bank of Japan also cut its bond purchases, with Governor Kazuo Ueda citing yen weakness as a factor in rising inflation. This strengthened the yen from 162 to below 150 against the USD.

The Australian dollar (AUD) weakened against all major currencies, with a nearly 4% drop in the trade-weighted index. Lower inflation reduced RBA rate expectations, hurting the AUD, but narrowing interest rate differentials with the USD might offer future support.

Looking for personal financial advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.