Economic Snapshot: Global equity markets remain positive

Markets began to factor in the possibility that the next move by the Reserve Bank of Australia (RBA) might be an increase rather than a decrease in May. This shift was influenced by higher and more persistent inflation data, the expansionary 2024-25 Budget, and the upcoming $23 billion in tax cuts set to begin in July.

Global equity markets, buoyed by a positive economic outlook and improved inflation data, more than recovered from April's decline, climbing 2% and bringing the year-to-date performance to 12%.

In Australia, equities saw a modest rise of 0.9% for the month, resulting in a year-to-date increase of 3.2%. The banking sector had a strong month, as did real estate, utilities, and pharmaceuticals, while the communications and retailing sectors experienced significant declines.

Throughout May, global bond yields settled at lower levels due to renewed disinflation news and a slowdown in US growth. Meanwhile, Australian bond yields remained relatively steady, influenced by the higher-than-expected inflation data for April, as well as signs of slower growth both domestically and in the US.

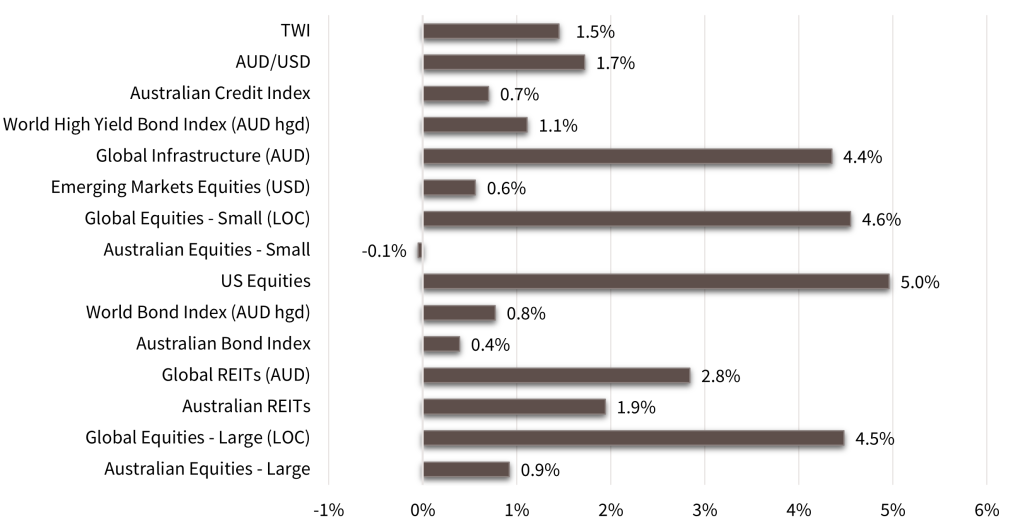

Asset Class Returns - May 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 123, May 2024

Global Developed Equities

Global equity markets performed well in May, supported by a positive economic outlook and improved inflation data. The MSCI World ex-Australia index rose 4.5%, reversing April's decline, and is up nearly 10% year-to-date. In AUD terms, the index increased by 2% for the month.

US core inflation rose by 0.3% in May, allowing the annual rate to drop to 3.6%. This disinflation trend, along with softening labour market indicators, led to a decline in bond yields from 4.7% to 4.51%. Lower oil prices also contributed to reduced near-term inflation expectations.

US earnings growth surprised positively, with a 5.9% increase over the year to March, the best result since Q1 2022. Mega-cap stocks, particularly in communications, IT, and consumer discretionary sectors, drove significant gains. AI-related stocks continued their strong performance, boosting the US market by 4.7%, while Europe ex-UK rose 5.2%.

Economic activity softened slightly in the US, with the ISM manufacturing index falling below 50 and labour market indicators showing a downturn. However, inflation news remained positive, supporting market expectations of a "soft-landing."

In Europe, improved manufacturing and services PMIs and inflation nearing target levels suggest potential rate cuts by the ECB and BoE, supporting European and UK equities.

Australian Equities

Australian equities rose 0.9% over the month, bringing the year-to-date increase to 3.2%, lagging global equities. Banks, real estate, utilities, and pharmaceuticals performed well, while communications and retailing declined sharply.

Australia's slower performance is due to its lower exposure to AI and productivity-improvement-related stocks and weak domestic growth. Global EPS growth is expected at 10% for the next 12 months, while Australian company earnings are forecast to grow by only 2.5%.

The Australian market is currently challenged by slowing growth and persistently high inflation. April's inflation rate of 3.6% exceeded expectations. Upcoming tax cuts ($23 billion) and the 2024-25 Budget's energy bill support package ($3.5 billion) have led to market expectations of possible interest rate hikes.

Despite this, the economy's slow growth rate of 1.1% annually, weak retail spending, and declining business orders suggest that cash rates may eventually decrease.

The May 2024-25 Budget projects slower growth and larger future deficits following this year's lower fiscal surplus. Treasury expects inflation to fall into the 2-3% target range sooner than the RBA anticipates, partly due to the Budget's policies.

Emerging Markets

Emerging markets underperformed compared to developed markets, with key markets like Korea and Brazil dragging down returns. The MSCI Emerging Markets index fell 1.8% in AUD terms.

EM Asia was up 1.4%, led by a 2.4% rise in China and a 5.3% gain in Taiwan, while Korea dropped 3.6%. Brazil was the biggest detractor, down 5%, due to concerns over central bank independence.

Chinese economic data indicates a modest recovery driven by trade and exports, despite weakness in the property sector and low consumer confidence.

May's PMI data showed activity below the critical 50 level, and retail sales growth fell to 2.3%. To support the housing market, China announced lower down payment requirements and a USD$41 billion re-lending program for social housing.

Several emerging market central banks have eased policy in response to declining inflation. Although risks like US dollar strength and regulatory issues in China persist, easier policies and a potential global manufacturing recovery are positive for emerging markets.

Property and Infrastructure

After significant losses in April, REITs rebounded in May. The (Australian) AREITs index rose 1.9%, bringing the year's gain to nearly 10%. The decline in bond yields and strong performance from Goodman Group, due to its data centre exposures, contributed to this rise.

Global REITs advanced 2.8% but remain down nearly 3% year-to-date. The FTSE Global Infrastructure index had its best performance since November 2023, rising 4.4% as real yields decreased. The sector is attractively priced compared to the broader equity market.

Fixed Interest – Global

US bond yields fell due to disinflation news and slower US growth. Despite the Fed's cautious stance on rate cuts, core inflation outcomes of 0.2-0.3% monthly could allow for easing. The core PCE price index for May was 0.3%, with an annual rate of 2.8%.

The 10-year Treasury yield dropped from 4.69% to 4.51%, with early June seeing further declines. Softer labour market data, lower Q1 GDP, and a weak May ISM report also contributed to the lower yields.

Fed Chair Jerome Powell emphasised maintaining current rates longer due to persistent inflation but did not expect further rate hikes.

Other major bond markets saw rising yields, particularly Japan, where the 10-year yield reached 1.07%, the highest since March 2012, driven by a recovering economy and prolonged inflation above 2%.

In Europe, improved economic data and PMI readings indicate recovery, with expected rate cuts from the ECB and BoE. German bond yields rose to 2.7%, and the UK's 10-year yield increased to 4.48%. The Barclays Global Aggregate index returned 0.8% for May but remains negative year-to-date.

US 10-year TIPS (Treasury Inflation-Protected Securities) yields ended May at 2.16%, with implied inflation expectations around 2.3%. Corporate credit spreads remain stable, with high yield spreads at 320 basis points (3.2%) and investment grade spreads (the margin, or yield above benchmark, government bond yields) at 88 basis points (0.88%).

Global high yield credit returned 1.1%, and investment-grade bonds added 1.3% for the month.

Fixed Interest – Australia

Australian bond yields remained steady in May, influenced by higher-than-expected April inflation and signs of slower growth in Australia and the US. The benchmark Bloomberg Composite Bond Index returned 0.4% for the month and is down 0.6% year-to-date.

Markets are now considering the possibility of a rate hike by the RBA, with no cuts predicted until late 2025. This outlook is driven by sticky inflation, the expansionary 2024-25 Budget, and upcoming $23 billion in tax cuts.

Despite this, weak retail sales, declining hours worked, and lower forward orders suggest the economy is slowing, which could lead to easing.

Commodities

Commodity markets were mixed. Oil prices fell 7% to $81.63 a barrel due to OPEC+'s gradual easing of production restrictions, though oil is up 6% year-to-date.

Copper was flat after a strong early-year rise of nearly 18%. Iron ore increased 6.1% in May but is down 17.5% for the year.

Chinese growth appears stable, with efforts to support the housing market. Gold prices rose to $2,327.34, up 12.8% year-to-date, driven by high central bank purchases and investor demand amid political risks and US-China tensions.

Currencies

The USD weakened due to soft economic data and the lowest inflation in four months, raising prospects of policy easing. Central bank policies are diverging, impacting currency markets. The European Central Bank is expected to ease in June, while the US Fed might not ease until late 2024.

Europe's growth has improved more than the US, with faster inflation reduction.

The euro ended at 1.087, the GBP at 1.274, and the yen was steady at 157 to the USD. The Chinese renminbi weakened due to lower inflation and growth. The AUD rose to 66.53, driven by potential rate hikes and a stimulatory federal budget.

Looking for personal financial advice?

This investment update is a general overview of market movements in May 2024. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.