Economic Snapshot: Core inflation eases

In October, core inflation eased to 3.5%, while headline inflation fell back into the Reserve Bank of Australia’s (RBA) 2-3% target range for the first time since March 2021.

Despite this progress, RBA Governor Michele Bullock highlighted that the Australian economy remains “too hot,” referencing the persistently high level of capacity utilisation.

Global equity markets faced headwinds throughout the month, grappling with rising bond yields and a stronger US dollar. For Australian investors, the surging USD translated into a 3.5% return in AUD terms for October and a 21.1% return for the year to date, even as the Australian dollar lost ground.

The Australian equity market declined by 1.3% during the month, as investors recalibrated expectations around Chinese stimulus measures and absorbed the impact of higher bond yields. Among sectors, materials dropped 4.9%, energy fell 4.8%, and consumer staples, REITs, and utilities also saw losses.

October also saw a global selloff in bond markets. International bonds fell 1.5% over the month but remained up 1.9% for the year to date. Australian bonds fared worse, contracting 1.9% in October and erasing much of the gains made in the third quarter, with a year-to-date return of 1.3%.

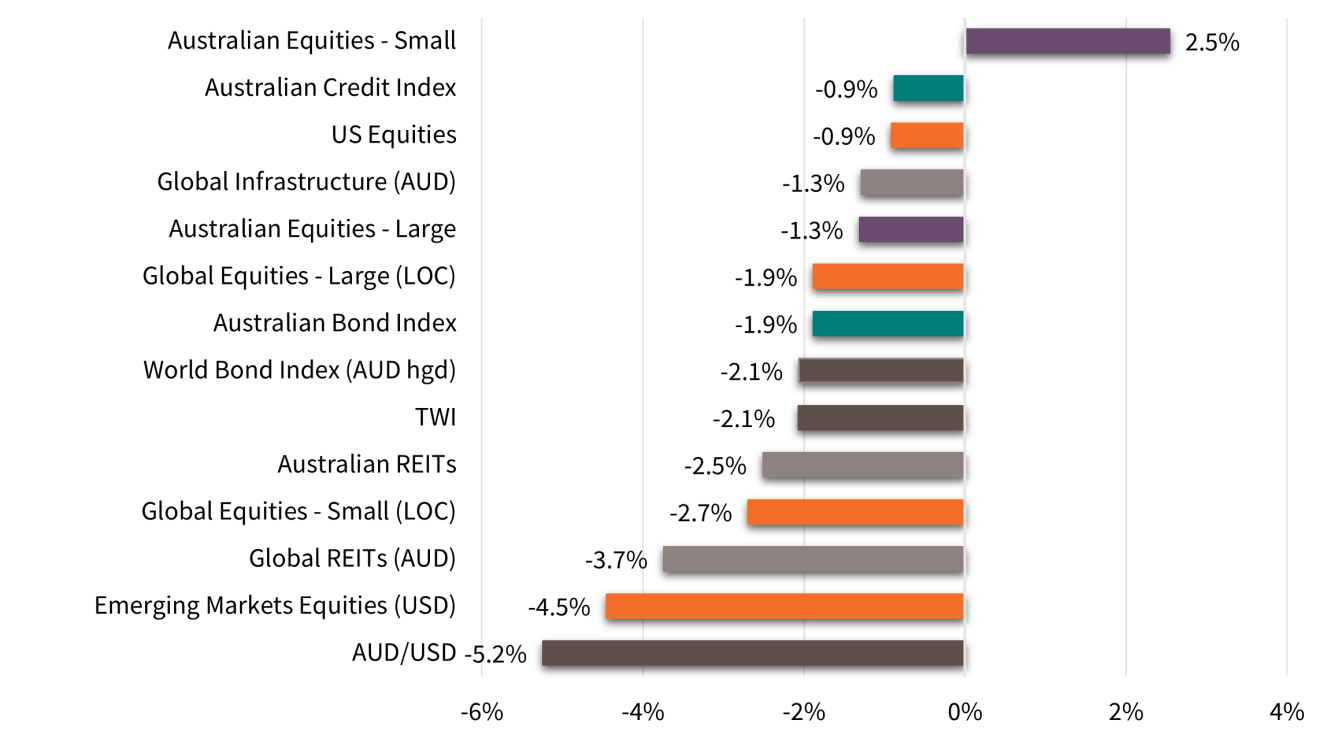

Asset Class Returns - October 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 128, October 2024

Global Developed Equities

Global equity markets faced challenges in October as rising bond yields and a stronger US dollar weighed on performance. Resilient US economic data and the possibility of a Trump presidency led markets to scale back expectations for interest rate cuts, with 12-month Fed funds forecasts rising from 2.9% to 3.7%.

A solid US GDP growth rate of 2.8% in Q3 reinforced the view that the Federal Reserve is unlikely to ease policy as much as markets were previously anticipating.

The MSCI World ex-Australia index generated a -1.9% return in USD terms, though a weakening Australian dollar boosted returns to 3.5% for the month and 21.1% year-to-date in AUD terms. The S&P 500 continued to hit record highs, fuelled by strong earnings growth, with Q3 profits up 5.1% year-on-year and a 14% growth forecast for the next 12 months.

Japan's TOPIX rose 1.9% in local terms but faced currency headwinds as the yen fell sharply. In USD terms, Europe ex-UK was the weakest region, down 6%, while the US and some Asian and European markets led year-to-date performance. Defensive stocks and materials struggled, while quality and growth sectors maintained strong year-to-date gains, above 21%.

Australian Equities

The Australian equity market fell 1.3% in October as investors reassessed the impact of Chinese stimulus measures and rising bond yields. Materials and energy sectors led the declines, down 4.9% and 4.8%, respectively. Consumer staples, REITs, and utilities also dropped, while financials and healthcare saw gains, with financials hitting a record price-to-earnings ratio of 18.3x.

Economic conditions provided some positive signals. Core inflation eased to 3.5%, and headline inflation returned to the 2–3% target range for the first time since early 2021. Improved consumer sentiment, likely driven by lower inflation and tax cuts, coincided with steady unemployment at 4.1% and the addition of 64,000 jobs in September. However, the Reserve Bank of Australia (RBA) warned the economy remains “too hot,” given high-capacity utilisation.

Interest rate expectations shifted during the month. Markets now anticipate 50 basis points (or 0.5%) of rate cuts by late 2025, down from earlier forecasts of 100 points (or 1.0%), contributing to pressure on bond yields and equities. Earnings growth in the Australian market is expected to remain weak, and valuations in sectors like banking appear stretched. Future market performance will hinge on interest rate developments and potential fiscal stimulus from China.

Emerging Markets

Emerging markets fell 4.4% in October after a strong September, weighed down by limited Chinese stimulus, rising bond yields, and a stronger USD. Key markets like China (-5.9%), India (-8.3%), and Korea (-7.6%) saw declines, while Brazil also struggled. However, in AUD terms, emerging markets gained 1.4% for the month, bringing the year-to-date increase to 16.6%.

Uncertainty around US-China trade relations added pressure, with President Trump suggesting a 60% tariff that could reduce annual Chinese growth by an estimated 1%. On a positive note, China is expected to announce a 10 trillion-yuan (or ~US$1.4tr) fiscal stimulus over three years, equivalent to 2–3% of GDP annually, which could support future growth.

Property and Infrastructure

Rising bond yields led to a sell-off in REITs and infrastructure stocks in October as markets adjusted interest rate expectations. AREITs fell 2.5% but remain up 23% year-to-date, driven by retail sector recovery and Goodman Group's strong performance. GREITs dropped 3.7%, reducing their year-to-date gain to 7%, while global listed infrastructure declined 1.3%, maintaining a 14.5% gain this year.

Fixed Interest – Global

The US labour market showed surprising strength in October, with non-farm payrolls rising by 254,000, far above expectations, and unemployment dipping to 4.1%. Wages grew 4% annually, while service activity increased, reflected in the ISM Services Index rising to 54.9.

Inflation continued its decline but at a slower pace, with headline inflation at 2.4% and core inflation up 3.3% year-on-year.

Sticky inflation led markets to scale back expectations for Federal Reserve rate cuts, pricing in fewer reductions over the next year. The US 10-year yield rose to 4.28%, reflecting persistent inflation concerns and political uncertainty relating to the election.

In the UK, economic and inflation data cooled, with forward-looking PMI indices falling. The Bank of England hinted at a dovish stance, but attention shifted to fiscal policy, as Gilt yields rose to 4.45%.

The Eurozone showed early signs of a recession, with PMI readings below 50 in major economies. Inflation dropped below 2% for the first time in over three years, but labour markets remained stable for now.

Global bond markets faced a sell-off in October, with the Barclays Global Aggregate index down 1.5%. Credit spreads narrowed for both investment-grade and high-yield bonds, approaching record lows.

Fixed Interest – Australia

Australia saw its strongest job growth in 16 months in September, adding over 64,000 jobs. Most of these came from public sector demand in health, education, and other services. Despite a record-high participation rate of 67.2%, the unemployment rate held steady at 4.1%.

Headline inflation dropped to 2.8% in September, its lowest in over three years, thanks to government rebates and lower fuel prices. However, underlying inflation, which excludes volatile items, eased only slightly to 3.5%, remaining above the Reserve Bank of Australia's (RBA) 2-3% target. RBA Governor Michele Bullock emphasised that sustained progress on lowering inflation is essential before considering rate cuts.

Economic growth appears to have stabilised, with expectations of improvement in 2025. Consumer sentiment rose to its highest level since May 2022, and business conditions, as per the NAB survey, were steady with forward orders holding up.

The Bloomberg Composite Index fell 1.9% in October, erasing most Q3 gains, but remains up 1.3% for the year. Despite mixed signals, the outlook shows signs of resilience in jobs and consumer confidence, though inflation and growth challenges persist.

Commodities

Commodity markets showed mixed performance in October. Brent crude rose early due to Middle East tensions but ended the month up 2% at $73.17 per barrel. Iron ore gained on Chinese stimulus, peaking at $113 before settling at $103.78. Copper prices declined, while gold surged to a record $2,744, marking a 33% increase for the year.

Currencies

The USD strengthened in October as markets lowered Fed rate cut expectations and reconsidered a Trump victory. The DXY index rose to 104 from 103.3. The GBP fell 3.9% to 1.29, its lowest in two months, following the UK autumn budget.

The yen weakened to 152/USD, and the AUD had its worst month, dropping 5.4%, driven by rising US rates and waning confidence in Chinese stimulus.

Looking for personal financial advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.