Economic Snapshot: All eyes on interest rates

In June, markets began to anticipate that the Reserve Bank of Australia's (RBA) next move might be an increase rather than a decrease. By the end of the month, there was a 60% chance predicted for a rate hike by September, with an easing expected by mid-2025.

This shift in outlook was driven by the last two inflation reports, which were higher than expected.

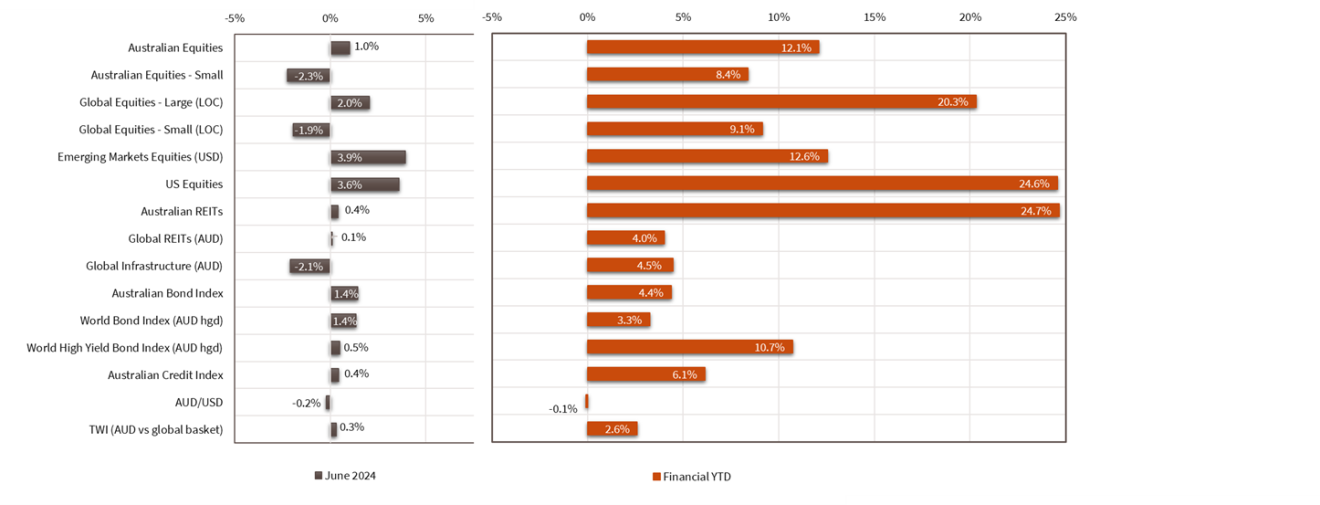

Global equity markets rose by 2.1%, concluding a very strong financial year with returns of 20.3% in AUD terms. Australian equities also saw a modest rise of 1% for the month.

Over the year, Australian equities lagged their global counterparts, increasing by 12.1%. Notably, the banking sector had a strong year, rising by 29%, consumer discretionary was up 22.3%, and IT increased 28.2%, while consumer staples, materials, and energy sectors saw declines.

The US 10-year bond yield, after peaking at 4.7% in April, ended the quarter at 4.36%. Australian bond yields fluctuated between 4.1 and 4.42% during the month, but the overall trend for the quarter was upward as markets considered the potential for another RBA rate hike, different to many global peers that have halted increases and are in some cases now cutting. By the end of June, the Australian 10-year yield stood at 4.36%.

Asset Class Returns - June 2024 (1 month) and 2024 Financial Year

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 124, June 2024

Global Developed Equities

Global equity markets rose 2% in June, ending a strong year with 20.3% returns in AUD terms. Despite an April stumble due to an unexpectedly high inflation print, improved inflation readings in April and May boosted market confidence. US bond yields declined from April's 4.7% high, supporting this optimism.

Mega-cap AI-related stocks dominated the quarter. In the US, these stocks lifted the S&P 500 by 4.2%, while the equal-weighted index fell by 2.6%. The global IT sector, led by Microsoft, Apple, and Nvidia, surged 11.4% for the quarter and 38% for the year.

The Communications sector, driven by Meta and Alphabet, rose 8.1% for the quarter and 37.2% for the year. Sectors like financials, industrials, and materials saw negative returns, reflecting a less positive economic backdrop.

US earnings per share (EPS) grew 8.8% in the June quarter, with expectations for a 13% increase over the next year. The Communications, Healthcare, and IT sectors saw over 16% growth, while Consumer Staples, Industrials, and Materials declined. Globally, earnings growth is forecasted at 10.8%.

Improved inflation data eased US bond yields to 4.34% by the quarter's end. AI-driven companies continued to perform well. The US market rose 3.9% for the quarter, outperforming Europe and Japan.

In Europe, political shifts and economic data impacted markets. The US labour market showed signs of balancing, while global manufacturing and trade improved, albeit with consumers feeling the pinch of higher rates.

Australian Equities

Australian equities rose 1% in June but fell 1.1% for the quarter, underperforming global markets.

A 5% gain in the banking sector in June helped offset losses in materials and energy stocks. For the year, Australian equities increased by 12.1%, with banks up 29%, consumer discretionary up 22.3%, and IT up 28.2%. However, consumer staples, materials, and energy sectors declined.

Australia's slower performance is due to its lower exposure to AI-related stocks and weak domestic growth. While global earnings per share (EPS) growth is expected to be 11% over the next 12 months, Australian earnings are forecasted to grow by just 3%.

Higher-than-expected inflation in Australia is also a factor, reducing the likelihood of monetary policy support. Earlier in the year, the market anticipated three rate cuts over 12 months. After a 4.4% CPI result in May, markets adjusted their expectations and are now predicting a 60% chance of a rate hike by September and easing to be delayed until sometime in mid-2025.

The Reserve Bank of Australia (RBA) faces challenges from fiscal stimulus measures, including $23 billion in tax cuts and an energy bill support package. Despite these measures, the economy slowed to a 1.1% annual growth rate, with weak discretionary spending, declining business orders, and reduced working hours suggesting potential future rate cuts.

Emerging Markets

Emerging markets outperformed global markets in June, marking only the third quarter of such performance since 2020. The MSCI Emerging Markets Index rose 2.6% for the quarter, compared to 0.7% for developed markets. For the year, emerging markets increased 12.2%, while developed markets rose over 20%.

Chinese equities were up 7.1% for the quarter, supported by government moves to boost the real estate sector. Taiwan and India drove much of the emerging markets index growth, with Taiwan's TSMC (semiconductor chip manufacturer) leading the semiconductor market and contributing to a 15.1% gain.

India saw a 10.2% increase, with earnings growth expected to exceed 12%, though valuations are high.

China's economic data is mixed, with ongoing challenges in the property sector but improvements in manufacturing and trade. India's strong equity market and economic growth continue, despite political challenges following a surprising election result for Prime Minister Modi's party.

Property and Infrastructure

The AREITs index fell 5.6% in the June quarter. Larger retail and office stocks dropped 5-15%, but with the newly focused data centre strategy, Goodman Group, which makes up 40% of the index, rose nearly 5%.

For the year, the AREITs index increased by 24.6%, driven by a 73% gain in Goodman Group, while many office and retail trusts remained flat or declined.

Global REITs declined by 2.6% for the quarter and rose 4% for the year. They are trading at discounts to their property valuations, suggesting a reasonable outlook. Offices continue to struggle due to remote work trends that have become entrenched, while retail-focused REITs benefited from a strong consumer base, with many malls reporting high occupancy.

The FTSE Global Infrastructure Index rose 1.3% in the June quarter and 4.5% for the year. Despite a challenging 12 months due to a 50 basis point rise in real bond yields, the sector now seems attractively priced compared to the broader equity market

Fixed Interest – Global

In April, the US 10-year bond yield peaked at 4.7% due to higher-than-expected CPI results but ended the quarter at 4.36%. Signs of disinflation in April and May and slowing US growth led to a modest bond market rally.

The Fed raised its 2024 inflation projection and now expects only one rate cut in 2024, down from three projected in March. Markets, however, anticipate nearly two rate cuts by year-end, starting in September, with the Fed funds rate expected to reach 3.75% by early 2026, assuming a "soft-landing" scenario with inflation at 2.5%.

US economic data has been mixed. May payrolls exceeded expectations, but rising unemployment claims and balanced job openings suggest easing wage growth. Household "excess savings" from the pandemic are nearly exhausted.

In Europe and the UK, inflation is easing, and growth is slowly improving. The ECB cut rates for the first time in five years. France’s bond market was impacted by political shifts following European parliamentary elections, causing concerns over its outlook.

Japan’s bond yields rose to 1.05%, with inflation above 2% for over two years. The Barclays Global Aggregate Index returned 0.4% for the quarter and 3.25% annually.

Corporate credit spreads remain stable, indicating ongoing economic expansion and stability. High yield spreads ended the quarter at 321 basis points, and investment-grade spreads at 96 basis points – these are the premiums over bond yield benchmarks investors are willing to accept for taking on higher risk – with global high yield credit returning 0.9% and investment grade (IG) bonds 0.6% for the quarter.

Fixed Interest – Australia

Australian bond yields rose in the quarter, with the 10-year yield ending at 4.36%, up 36 basis points, and the 2-year yield up 50 basis points to 4.2%. This led to a -0.2% return for the Bloomberg Composite bond index for the quarter and 4.4% for the year.

Markets are pricing in a 60% chance of an RBA rate hike by September, with easing expected by mid-2025, due to higher than expected inflation (CPI). May CPI showed annual inflation rising to 4%, with core inflation at 4.4%. The RBA has indicated readiness to raise rates if inflation remains above forecasts.

Growth remains subdued, despite an uptick in consumer spending on overseas travel. Savings are lower, hours worked have decreased, and business forward orders are declining. However, tax cuts, energy bill support, and state government spending are expected to boost demand in the coming quarters.

Commodities

Commodity markets were mixed in June. Brent crude oil rose 5.8% to $86.4 per barrel due to geopolitical risks and positive demand expectations, despite concerns over OPEC+ easing production restrictions. Oil is up nearly 17% for the year.

Copper lost ground in June but is up over 16% for the year, driven by energy transition demand and improved global growth. Iron ore dropped 9.4% in June due to weak seasonal steel demand and increased port stocks in China.

Gold remained flat in June at $2,326 but is up nearly 22% for the year, supported by political risk diversification and central bank purchases.

Currencies

The USD strengthened in June due to political developments in France affecting the Euro and the Bank of Japan not tightening monetary policy, with the Euro ending at 1.071 and the Yen at 160.88.

Diverging central bank policies are impacting currency markets: the ECB eased, the US Fed is not expected to ease until September, and the RBA may raise rates.

Growth has improved more in Europe compared to the US, while inflation is decreasing faster in Europe.

The Chinese renminbi weakened due to lower inflation, weaker growth, and easier policies. The AUD rose to 66.7, driven by higher inflation data and potential rate hikes.

Looking for personal financial advice?

This investment update is a general overview of market movements for the month. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.