2024 Federal Budget Update

Last night, Treasurer Jim Chalmers handed down his third budget trying to balance the fine line between providing cost of living relief and not stoking more inflation, aiming to avoid a pre-election interest rate rise.

Many pundits believe he might have pulled it off. It’s certainly not a pre-election budget full of giveaways, but with a surplus achieved and an election due by September 2025, we can still expect some additional giveaways down the track.

From a hip-pocket perspective, FMD clients will benefit from the Stage 3 Tax Cuts which are unchanged from amendments made earlier this year, along with cost-of-living measures, including $300 for every household to reduce energy bills, targeted benefits for aged pensioners such as the extension of the freeze on deeming rates and pharmaceutical co-payments.

There are also several measures for those on lower incomes including a small increase in JobSeeker payments for some, an increase in the Medicare levy thresholds, increased rent assistance and a reduction in student debt obligations.

There are few changes to superannuation. The increase in the Superannuation Guarantee rate to 11.5% (on its way to 12% from July 2025) was already legislated, while the payday super requirement and adding superannuation payments to government paid parental leave are sensible changes.

There other announcements about aged care, small business and increasing Australia’s housing stock and a long term “Made-in-Australia” initiative. Read on for more details on the budget announcements.

Personal tax

Stage 3 tax cuts

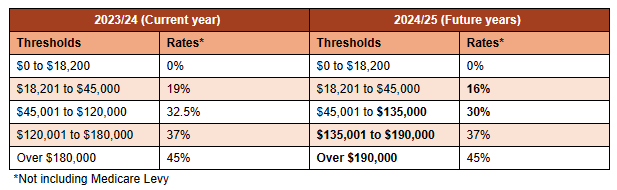

The already legislated Stage 3 tax cuts reduce personal income tax rates and thresholds for the 2024/25 financial year and beyond, resulting in tax savings for all taxpayers. The table below compares current tax rates and thresholds for 2023/24, to the new tax rates from 2024/25:

Superannuation

Super Guarantee Contribution

The minimum Superannuation Guarantee contribution that employers pay for each eligible employee is currently 11% of an employee’s ordinary time earnings (OTE). This is scheduled to increase to 11.5% on 1 July 2024, and increase again to 12% from 1 July 2025 onwards before being capped.

Paying super on Government-funded Paid Parental Leave

To address lower superannuation balances for women, the Government has announced it will pay super on the Government-funded Paid Parental Leave for babies born or adopted on or after 1 July 2025. Eligible parents will receive an additional 12% of their Government-funded Paid Parental Leave as a contribution to their superannuation fund.

Payday Super

Payday superannuation was previously announced in the 2023-24 Federal Budget. From 1 July 2026, employers will be required to pay their employees’ super at the same time as their salary and wages. Currently, employers are required to pay their employees’ Superannuation Guarantee contributions on a quarterly basis. This should help ensure employees receive their super entitlements.

Social Security and Medicare

Freezing of Deeming Rates

The deeming rate freeze was due to end on 30 June 2024, however, the Government has announced that the current lower and upper threshold rates of 0.25% and 2.25% respectively, will be retained for an additional 12 months (until 30 June 2025). The extension applies to all Centrelink and Department of Veterans Affairs income support recipients, as well as concession card holders, such as the Commonwealth Seniors Health Card. This should help protect pension entitlements for income tested recipients.

Pharmaceutical Benefits Scheme Freezes

Indexation of the Pharmaceutical Benefits Scheme (PBS) concessional co-payments will be frozen for 5 years from 1 January 2025 until 31 December 2029 for pensioners and Commonwealth concession card holders. This means that the maximum co-payment remains at $7.70.

Medicare card holders will also be subject to a one-year freeze on the maximum PBS patient co-payments until 1 January 2026.

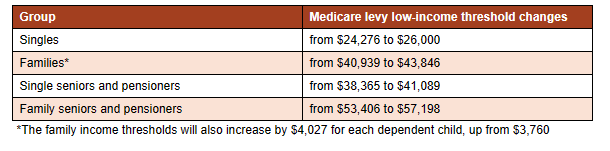

Increasing the Medicare Levy low-income thresholds

To provide cost-of-living relief, the Government has increased the Medicare levy low-income thresholds for singles, families, and seniors and pensioners from 1 July 2023 in an effort to ensure low-income individuals continue to be exempt from paying the Medicare levy.

Other Cost of Living measures

Power Bill Relief

With cost of living being a key focus, the Government has announced “Power Bill Relief” to apply from 1 July 2024. Every Australian household will receive a $300 credit that will be automatically applied to their electricity bill. As this benefit goes to the person whose name is on the bill, holiday homeowners may also receive the benefit. All credits will be applied in quarterly instalments.

Debt Relief for Students

A cap will be placed on the indexation of Higher Education Loan Program (HELP) debt to the lower of Consumer Price Index and Wage Price Index. This ensures that debt does not outpace wages growth. This change will be applied retrospectively to 1 June 2023, reducing an average loan balance by around $1,200.

Increased Commonwealth Rent Assistance

The maximum Commonwealth Rent Assistance will increase by 10%. The maximum payment for a single person will increase by about $18.80 to $207 per fortnight while a couple with one or two children will have their payment rise by about $22.10 to $243.30.

Rent Assistance will also index on 20 September 2024, as part of the twice annual review of rates.

Higher JobSeeker Payment Rate

Currently, the Higher Jobseeker Payment Rate is $816.90 per fortnight and is only available to:

single recipients who have a dependent child, or

single recipients over the age of 55 who have been receiving the JobSeeker Payment for more than nine continuous months.

The Government has announced that, from 20 September 2024, single recipients who have an assessed partial capacity to work up to 14 hours per week will also be eligible for this higher payment rate. This represents an increase of $54.90 per fortnight compared to what recipients currently receive.

Small Business

$20,000 instant asset write-off extended

The Government has announced that it will extend the $20,000 instant asset write-off by 12 months until 30 June 2025. Small businesses, with an aggregated annual turnover of less than $10 million, will continue to be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use by 30 June 2025. The asset threshold applies on a per asset basis so small businesses can instantly write off multiple assets. Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool and depreciated at 15 per cent in the first income year and 30 per cent each income year thereafter.

Power Bill Relief

The Government announced it will also provide “Power Bill Relief” for small businesses. This will apply to approximately one million businesses on small business customer electricity plans and will be rolled out in quarterly instalments.

Aged Care

As the Aged Care sector continues to reform in response to the Royal Commission into Aged Care Quality and Safety, measures announced in last night’s budget primarily focused on funding the logistics of implementing these changes. There was an announcement of a further 24,100 Home Care Packages, designed to both decrease the waiting times by six months and to allow the Government to temporarily reduce the expected number of residential Aged Care places provided for.

Housing

Housing Construction

An additional $1 billion is being allocated to states and territories through the Housing Support Program. This funding aims to assist state and territory governments in constructing "enabling infrastructure" for new housing developments. This infrastructure includes crucial services such as water supply, electricity, sewerage systems, and roads, which are essential for the functionality and liveability of residential areas. This substantial investment builds upon the initial commitment of $500 million, demonstrating a concerted effort to address the infrastructure needs associated with housing growth and development.

An extra $423 million will be added into the National Agreement on Social Housing and Homelessness over the span of five years starting from 2024-25. This funding surge is aimed at strengthening support for social housing initiatives and services dedicated to addressing homelessness.

Foreign investors will be permitted to acquire established Build to Rent developments with a reduced foreign investment fee, provided that the property remains operated as a Build to Rent development.

Construction Sector Education

The Government will dedicate $88.8 million over a three-year period to create 20,000 fee-free TAFE and VET positions. This endeavour will additionally broaden the availability of pre-apprenticeship programs tailored for students in the construction sector, aimed at increasing the capacity and reducing wage inflation in the sector.

International Student Accommodation

Universities will be required to build more student accommodation if they want to increase their enrolments of international students. There will be a limit to how many international students can be enrolled by each university based on a formula, including how much housing they build.

A Future Made in Australia

Finally, the Government announced an ambitious $22.7 billion investment over the next decade to build capacity in Australia around clean energy and renewable energy as part of the energy transition to net zero. It aims to make Australia a renewable energy superpower in a way that creates secure, well-paid jobs across the country.

It is a laudable objective and Australia does have many natural advantages and skilled workers to make this a reality, but picking winners is incredibly difficult to do and it will remain to be seen how successful this can be. Successive governments threw billions at the Australian car industry, and we know how well that ended.

If you have any questions about this summary or any other budget questions, please contact your FMD Adviser.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.